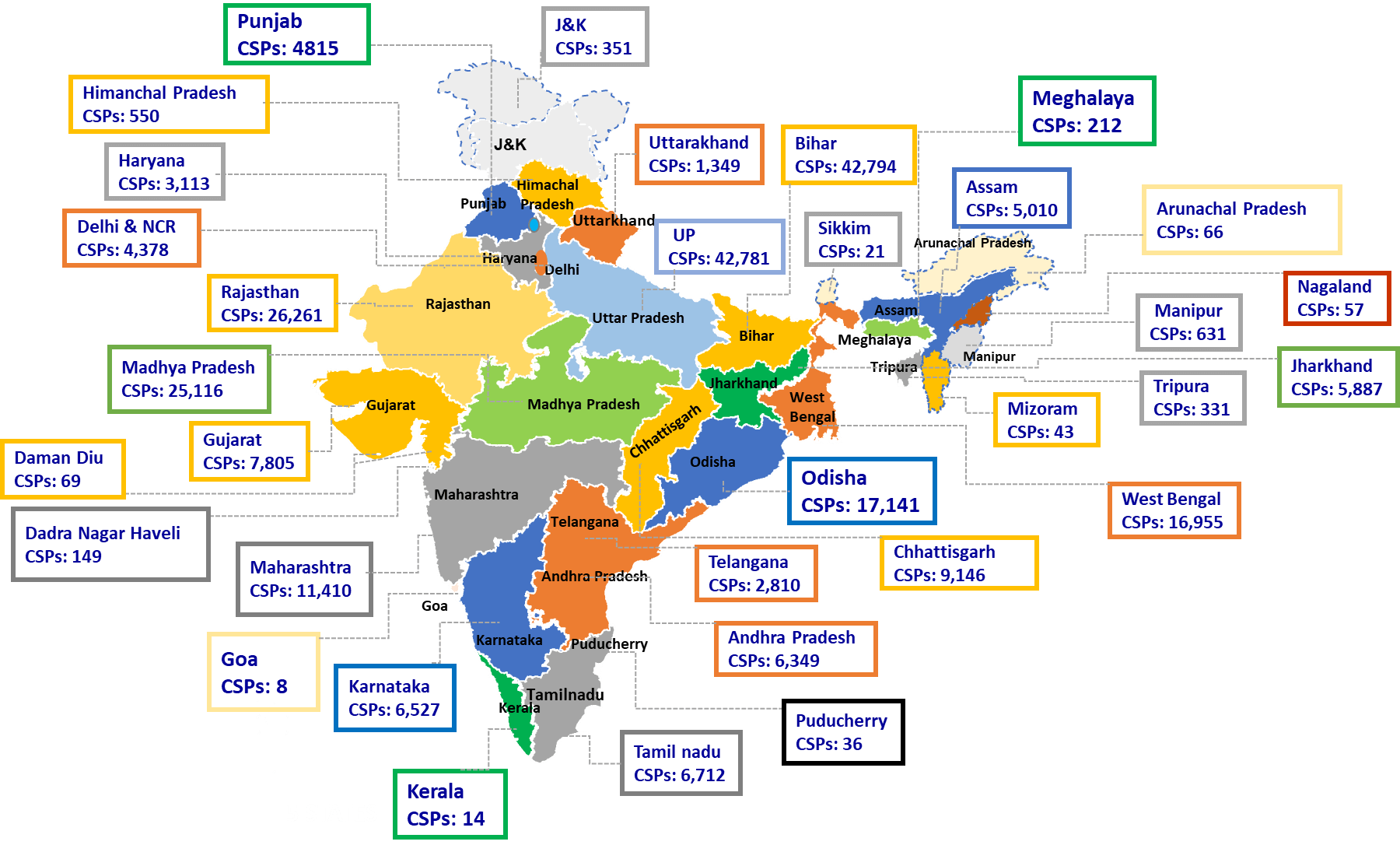

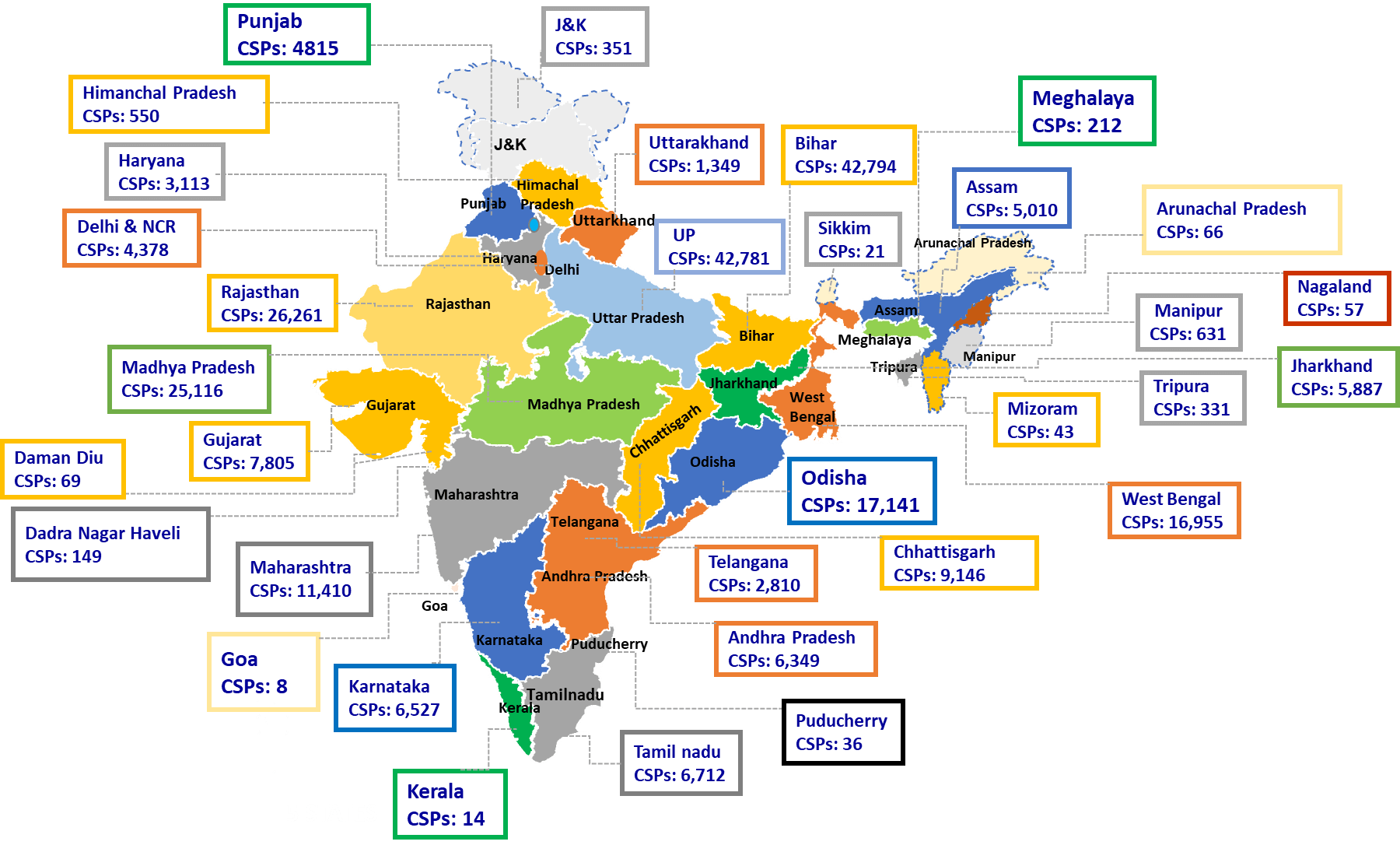

3,00,00,000+ Lives Improved

Customer Service Points

+ cities

across districts

+ Crore

Gross Transaction volume

Customer Service Points

across districts

Gross Transaction volume

Sameer is a highly accomplished and visionary leader, bringing over two decades of extensive executive experience in business strategy, channel development, and P&L management to the table. He is the Founder and Managing Director of ROINET, which he established eight years ago, drawing from his vast experience and entrepreneurial spirit.

Prior to founding ROINET, Sameer held key positions at top corporates such as Modi Xerox and Hewlett Packard. During his tenure at Hewlett Packard, he served as Country Director, spearheading the growth of the channel business to a remarkable USD 2 billion. Sameer's experience and expertise have been critical to the success of his current organization, as he continues to drive growth and profitability through innovative business strategies and partnerships.

Sameer holds an Economics Honors degree from St. Xavier's College, Kolkata, and an MBA from the prestigious SP Jain Institute of Management and Research. He also completed the Sloan Fellows program at the renowned MIT Sloan School of Management.

In summary, Sameer is a highly accomplished and visionary leader who has made significant contributions to the growth and success of his organization. He recognizes the value of his team's collective efforts, invests in his personal and professional growth, and fosters an inclusive and supportive work environment. His vast experience and expertise, coupled with his collaborative leadership style, make him a valuable asset to any organization looking to drive growth, profitability, and innovation.

Chon-Phung is a distinguished board member of ROINET, bringing to the table extensive experience, expertise, and a strong commitment to driving social impact through inclusive innovation.

As a partner in a top private venture investment group, Chon-Phung has a deep understanding of the startup landscape, and he has served on the board of multiple startups in the region, providing valuable guidance and support to these companies. Additionally, Chon-Phung actively leads social impact initiatives that focus on creating inclusive innovation for the betterment of society and the economy.

With an MBA from the prestigious University of Chicago Booth School and a PhD from the highly respected Singapore Management University, Chon-Phung possesses a wealth of knowledge and expertise. His academic background and professional experience have equipped him with a deep understanding of business strategy, innovation, and entrepreneurship.

Prior to his current role, Chon-Phung held high-ranking positions at leading tech giants such as Oracle and Hewlett-Packard, where he made significant contributions to driving growth and profitability. In particular, he served as Senior Vice President at Oracle Customer Support Services in Asia Pacific and Japan and Vice President and General Manager for the Enterprise and Public Sector business segments at Hewlett-Packard in Asia Pacific and Japan.

Mr Sanjeev Nautiyal began his career with SBI as a Probationary Officer on October 1st, 1985. He holds an M.B.A and is also a Certified Associate of Indian Institute of Bankers (CAIIB).

In his 36 years with SBI, Mr. Nautiyal has had wide ranging exposures to various areas viz; i) Lending to MSME/Mid-Corporates, Retail (Housing, Auto, Personal Loans), Agriculture & Micro Loan Segments ii) Financial Inclusion, iii)International Banking iv) Life Insurance v) Human Resource Management. He assumed various Leadership positions at SBI and delivered very significant contributions in these roles.

As Deputy MD (Financial Inclusion & Micro Market), he oversaw portfolio in Agriculture and Micro Loans of Rs 2.45 lac crores, serving 1.35 crore customers, driving numerous policy initiatives towards embracing Digital in the Lending portfolio. Under his stewardship stitching of Partnerships/Collaborations with NBFCs/NBFC-MFIs for Digital Co-Lending were undertaken.Partnership with Agritechs for Sourcing, Servicing and Collection of Micro-Loans was put in place. Lending to NBFC/NBFC-MFI for Onlending to Micro Segment /Priority Sector and Pool Purchase (Purchase of Micro Loan Portfolio) from NBFC/NBFC-MFI were also expanded.

As MD and CEO, SBI Life Insurance, he oversaw the Largest Bancassurance Channel among all Life Insurers & Biggest Agency Channel among Private Players. Digital Adoption & Protection/Non Par Business was focused. Distribution Channels were strengthened. Many New partnerships were put in place.

As i) Chief General Manager, Gujarat State, in charge of 1300 Branches and ii) General Manager (Rajasthan & Agra Zone) overseeing 600 Branches, all business and operation issues resided under his charge. SME, Retail (Housing, Auto, Personal Loans) & Agriculture Loans saw a big boost.

He served as Regional Head for Middle East, West Asia & North Africa based out of Bahrain and Dubai. He was responsible for all issues related to Business & Operations for Six Branches (Two in Bahrain; Dubai; Jeddah; Muscat; Doha) & Three Representative Offices ( Istanbul; Cairo;Tehran) of SBI spanning Eight Countries.

As CEO, Full Commercial Branch, Bahrain, local lending to SME and Retail segments saw tremendous growth.

He successfully managed Large Teams involving Business Development, Strategy and Execution. Adherence to i) Risk ii) Regulatory Compliance, and iii) Audit Frameworks remained central to his engagements. Delivering excellent and efficient Customer Service was always at the forefront of his motivation and focus.

In addition to having been a Whole Time Director at SBI Life (a listed entity), he was also on the Board of SBI FOUNDATION (CSR arm of SBI). He was also a permanent invitee to all the meetings of SBI Central Board, Executive Committee of Central Board, Audit Committee, Risk Management Committee, Compliance Committee, Customer Service Committee, IT and Digital Strategy Committee.

Kept abreast on the learning path through completion of online courses on Business/Organisation/Management : Edx (Five Courses) and Harvard ManageMentor (30 Courses)

External Trainings Attended

1)IIM Lucknow : Leadership

2)SP Jain Institute of Management, Singapore : Leadership

3)Berkeley University (Collaborated with AIMA) Silicon Valley, California : Disruptive Innovation and Open Business Model

4)Harvard University, Boston (Linkage's 20 Conversations@Harvard) : Leadership, Strategy, Execution

5)IDRBT, Mumbai : Certification Programme on IT & Cyber Security

As part of Investor Outreach at SBI LIFE, he met Investors at Hong Kong, Singapore, London, New York, San Francisco and Boston.

Current Engagements after retirement from SBI

1)Independent Director, Life Insurance Corporation(LIC)

2)Advisor,Investment Committee,Postal Life Insurance(PLI)

3)Advisor,Insolvency Proceedings(CIRP) of Reliance Capital

Vivek is an exceptional leader with a proven track record of success. As a seasoned member of the ROINET team, he has been instrumental in the development of the company's outstanding fintech platform. Serving as the Chief Technology Officer, his visionary leadership and expertise have enabled the company's customer service points to offer a full range of financial services, including basic banking, through the development of the innovative bill-pay and utilities platform, Xpresso.

With a career spanning over 22 years, Vivek has amassed extensive experience across diverse industry sectors such as financial inclusion, rural banking, third-party payment gateways, and telecommunications. His wealth of knowledge and expertise has been invaluable to the success of ROINET, as evidenced by the company's impressive growth and market dominance.

In addition to his impressive professional accomplishments, Vivek is also known for his exceptional interpersonal skills, which have allowed him to build strong relationships with team members, clients, and stakeholders. He is a collaborative leader who fosters an inclusive and supportive work environment, where team members are empowered to contribute to the company's success.

Sanjeev is a highly accomplished and visionary leader, serving as the Chief Growth Officer, responsible for driving the revenue growth strategy of the company, establishing new lines of business, and forging strategic alliances. He also leads the organization's customer experience and lending business initiatives, ensuring that the company delivers exceptional value to its customers and stays ahead of the competition.

With over 25 years of extensive experience in business strategy, channel development, and P&L management, Sanjeev has worked with industry leaders such as Xerox, Airtel, Zee, and Idea Cellular in the past. His vast knowledge and expertise have been critical to the success of his current organization, as he continues to drive growth and profitability through innovative business strategies and partnerships.

Sanjeev is a results-driven leader who is committed to achieving exceptional outcomes for his team and organization. He is a trusted advisor to the executive team, providing valuable insights and guidance on critical business decisions. His vast knowledge and expertise, coupled with his collaborative leadership style, make him a valuable asset to any organization looking to drive growth, profitability, and innovation.

Sakshi is a highly experienced and accomplished HR leader, currently serving as the Head of HR at ROINET, where she has been instrumental in driving organizational development, talent management, and change management initiatives. With over 14 years of experience in the field, she has gained deep expertise in people analytics, employee relations, compensation & benefits, and communication.

As a key member of ROINET's Leadership Team, Sakshi is committed to aligning the company's mission and strategic vision with its workforce, and ensuring that the organization has the right people, culture, and resources to drive growth and success.

Prior to joining ROINET, Sakshi has held several senior HR positions at leading organizations such as Mastek, Manipal Technologies, and FINO Payment Bank..

Become a one-stop banking and digital payments centre. Roinet technology platform is security certified which means all transactions on the platform are fully secure. Platform offers a best-in-the-industry success rate.

AEPS: Aadhaar Enabled Payment Service

DMT: Direct Money Transfer Service

Cash withdrawal via UPI/QR-Code

New account opening and Government Schemes

Choose from a wide range of Mini-ATM Roinet branded ATMs. Help your customers in withdrawing cash and making merchant payments using their debit/credit cards.

If you run other businesses from your shop, customers can purchase goods and make payments using an Aadhaar card and fingerprint. This service is called Aadhaar Pay. Similarly, customers have another option of making merchant payments by using the UPI/QR code.

Aadhaar Pay

Aadhaar Pay

Roinet has enabled more than 3,000 Women Mobile-Retailers in various states. They are called “BC-Sakhi”. These women do not possess any brick & mortar shop and carry the equipment with them for delivering the services to the doorsteps of residents in the nearby villages. Roinet relationship managers on the ground help these retailers with equipment training, application, and training.

If you do not own a shop but start earning money by delivering financial services to the doorsteps of customers, you may contact the Roinet Customer Care Centre.

Make your shop the travel hub of your area. Now customers do not need to stand in long queues at railway stations or travel to a travel agency for ticket bookings. You can offer all tickets and hotel bookings under one roof of your shop.

Roinet service portal (Xpresso) will offer the same features, reliability, and experience that a customer would receive while booking tickets at a railway station or any other travel agent.

Every household needs to pay various bills – electricity, water, gas, credit card - and recharge their phones and DTH connections. Traditionally customers have been traveling to various offices and standing in long queues to pay their bills. Roinet retailers can now offer all these services to their customers near their doorstep under one roof of their shop.

Electricity, Water, and Gas BillsThis is a common requirement of most households every month. They can now make payments for their utility bills at your shop.

While customers pay their bills at your shop every month, you get assured commission on every bill payment.

Recharge ServicesCustomers can now recharge their mobile phones and DTH connections at your shop as and when needed. Several customers recharge their phones multiple times a month. With the Roinet service portal (Xpresso), you can offer recharge services for all telecom operators and DTH service providers. While customers receive immediate recharge confirmation, you make money on all such recharge transactions.

Credit Card Bill PaymentsYou can now help your customers in making payments for their credit card bills up to Rs.2 Lacs. Credit card users need to pay their bills every month, therefore you receive assured income every month.

Customers can pay their credit card bills across 20+ banks. Retailers receive recurring commissions for all bill payments.

LIC Insurance Premium PaymentLIC has more than 28 Crore policy holders. Some customers also own more than one policy from LIC. Customer can pay their policy premium at your shop.

Customers can choose to pay premium frequency as per their policy terms – monthly, quarterly, half-yearly, annual – which provides you with frequent earning opportunities.

Customers who have availed loans from micro-finance companies and other product finance companies can pay their installment at Roinet retailer’s shop, instead of going to branch of the finance company.

Loan collection agents of micro-finance companies and product finance companies who collect cash from their borrowers can hand over the cash to the nearest Roinet retailer, instead of carrying the cash to their branch kilometers away.

Customers and collection agents can deposit the collected cash for 100+ micro-finance and other loan companies.

Roinet retailers can help customers with several services that they find difficult to do on their own and need guidance, such as applying for a PAN card or filing income tax and GST returns. They can now get help at your shop.

PAN Card

ITR and GST Return Filing Service

Roinet believes in empowering and enabling its channel partners to increase their income consistently. It is experienced that most retail partners run their businesses with very little working capital. Because of the constraints of working capital, they are not able to serve all available customers. Therefore, their income gets restricted to a certain level.

Roinet offers on-demand wallet credit with which retailers can grow transactions and increase their income. The lending product is customized for each retail partner.

Any retailers who transact on the Roinet platform for a minimum of three months and consistently grow their transaction volume become eligible for credit advances.

This is first-in-the-industry “Effectively interest-free credit”, subject to the retailer generating certain incremental transaction volume by utilizing the loan amount.

This offer is exclusively for Roinet channel partners.

+91-124-4154700

+91-124-4154700  contact@roinet.in

contact@roinet.in Partner Login

Partner Login